DAO or DAOs (decentralized autonomous organizations) regularly come up in IT news. But these stories often neglect some of the most important details about something, which is in itself a significant breakthrough. You’ll soon learn about what DAOs are and why they’re so important. By understanding more about DAOs, you’ll also get a grasp on developing technologies.

Quick Menu:

- What Is a DAO?

- What Makes DAOs Interesting?

- How Does a DAO Organization Work?

- DAO vs. Traditional Organizations

- An Overview of Different Types of DAOs

- How Governance Works Within DAO

- The 2 Major Types of DAO Memberships

- Examples of DAO Tokens Cryptocurrencies

- What Do the Critics of DAO Have To Say?

- What Does the Future Hold for DAO?

- The Metaverse as a Whole

What Is a DAO?

DAOs are a combination of people and software interacting through a blockchain that offers collective public management of the underlying codebase. One of the main differences between a DAO and a standard organization stems from using software for the infrastructure. The software itself imposes a set of rules on the governing body.

Membership within a DAO is tied in with an associated cryptocurrency. This is similar to having stock in a company. The percentile of assets on the blockchain correlates to voting within it.

BitShares popularized the idea of a DAO. The e-commerce platform linked customers and merchants together without needing a central authority. This concept was later termed a decentralized autonomous company (DAC) by BitShares founder Dan Larimer.

A DAO will have some elements of traditional organizations. For example, community members can create proposals. But everything is organized through blockchain.

Video: What is DAO?

What Makes DAOs Interesting?

The self-regulating nature of DAOs solves the issue of trust within Internet-based organizations. It usually’s hard to trust someone you only know through the web. But a DAO only requires you to trust the underlying codebase – which is open. This creates a perfect platform for easily trusted large-scale collaboration.

How Does a DAO Organization Work?

A DAO is heavily based on intelligent contracts created by a core community team. This can be thought of as a constitution of sorts. It’s always in sight, verifiable, and auditable. This is essentially baked into the blockchain. Visibility is one of the single most important points about DAOs.

Because a DAO lacks a central authority figure, it’s entirely governed by the codebase, intelligent contracts, and community members. There’s no way of knowing what’s going on behind closed doors with traditional organizations. The actual reasons for decisions aren’t always going to line up with stated intent. But everything within DAOs is visible.

Also, like a government, a DAO needs a treasury. Token issuance sold through the protocol will then help to create larger-scale funding. Sales of tokens build an economy and create voting rights among holders. At this point, the DAOs have funding, tokens, bylaws, and a community able to vote. It’s ready to go into action and will be deployed.

Once the code is deployed, it can only be changed through a consensus vote from within. This approach means that no one authority can seize control of it. The DAO community is essentially self-regulating with no central authority.

DAO vs. Traditional Organizations

The lack of a central authority and its overall transparency differentiates DAOs from traditional organizations. People often forget just how much influence systems have simply from the bias of regulators within them. People enforcing rules will usually wield some level of influence. But in a DAO, the system itself handles governance almost in the same way as laws of nature. Votes are appropriately tallied, outcomes implemented, and consensuses reached in the same way gravity causes an object to fall. This is because the rules of the DAO are inherent to the substate of the transactions, just as gravity is an inherent property of physics.

This also extends to how services are implemented. Consider a case where funds needed to be distributed to a third party. This would happen in a decentralized manner without any individual demanding changes. And all of this is publically visible.

An Overview of Different Types of DAOs

Of course, just like there are different organizational models within companies, there are also multiple forms of DAO. As with any technological system, there will always be new and innovative models. But the following conditions of DAO compromise the vast majority that is active today.

Investment DAOs

Investment DAOs are focused on generating a return on investments. It’s essentially a group of DAO members who pool their funds to generate the maximum possible return. This is typically done in the early stages of a project. The investment DAOs can help new projects while maximizing return by investing early.

Collector DAOs

Collector DAOs can be thought of as NFT art aficionados or investors. This DAO acts as a curator of sorts to collect NFTs from particular artists or platforms. It’s quite similar to how museum curators operate. A collector DAO works similarly to a private art gallery for NFTs.

Operating Systems DAOs

Operating system DAOs refer to the essential underlying framework of a DAO. This is essentially a collection of software and guidelines which make it easy for people to create a DAO without extensive programming skills. A community can come together with this DAO and essentially create a system from templates.

Protocol DAOs

Protocol DAOs were first formed as a means to issue ERC20 tokens, which have a secondary value on the market. The term comes from the fact that the tokens are often used as a way to govern protocols. It’s a framework to issue tokens that are community-owned and operated.

Service DAOs

A service DAO helps channel resources, or services, from one DAO to another. This is somewhat comparable to a talent agency for the open Internet. The fact that DAOs are based on the blockchain also makes it easy to offer crypto payments. It’s often thought that this is the future of employment.

Media DAOs

Media DAOs seek to ensure that people who consume content have creative control over it as well. This can be through media mining programs that use the blockchain to reward contributors. Or in other cases through incentivization of contribution to news aggregates. This keeps media moving in two directions.

Grants DAOs

Grants DAOs were among the first DAO usage cases. They function through donated funds from the community. Capital is then allocated through governance proposals. Interestingly enough, this mechanism was highlighted initially with non-transferable shares. The capital gains were often more in the form of social rather than financial returns.

How Governance Works Within DAO

There’s a great deal of variation between the different forms of DAO. But all of the DAOs work under reasonably similar governance. This governance comes under three main points of operation.

Voting Power

Voting power is determined by confirmed ownership of NFTs. This instantly makes the owner part of the larger governance procedure. It also helps to ensure that voting power is directly tied to self-interest. All DAO voters within the system are shareholders of a sort through their possession of the blockchain tokens.

Governance Tokens

With voting rights also comes access to governance. Because of this, the blockchain NFTs are also considered governance tokens. Ownership of governance tokens means that people can vote on proposals through the blockchain. Usually, the voting power increases at a comparable rate to someone’s overall token ownership.

Voting Delegates

Voting delegates are a partial solution to the problem of inactive holders. Many people only view their token ownership as an investment rather than a chance to help govern the community action. Voting delegation helps solve this by letting people delegate their voting privileges to people who do want an active voice.

The 2 Major Types of DAO Memberships

Membership and voting rights are among the most important foundational elements of a DAO. DAOs do have some variance in membership privileges, though. This mainly comes in the form of differentiation between a token-based and share-based membership.

Token-based

Token-based membership works by equating voting rights to ownership. It’s the most open form of DAO organization and is considered permissionless. Likewise, the trading or acquisition of tokens is freely available to the public with no real restrictions. This essentially translates to a system whereby anyone can enter into voting.

Share-based

Share-based DAOs are still reasonably open but are permissioned. Membership of a share-based system requires the submission of a proposal. Goods or services of some type typically accompany this. People most commonly use the appropriate token of the DAO. This form is more typical of charities or a closer-knit DAO.

Examples of DAO Tokens Cryptocurrencies

Tokens come up in any conversation about DAOs. But this is also one of the main points that differentiate different systems. There’s a large number of different tokens used among various DAOs. But these are the most common.

Uniswap

Image attribution: Uniswap

Uniswap launched in 2018 with a long-term goal to keep token trading automated and open. Likewise, to ensure that people who own tokens are free to work within the system to govern int. In 2020 UNI tokens were added to increase profitability and add a more active role in the form of DAO voting. Uniswap also avoids liquidity issues through automation.

Aave

Image attribution: Aave

Aave was initially known as ETHLend and rebranded in 2018. Holding Aave acts as a DAO system by providing people with governance. Essentially Aave ownership is a governance token. The tokens work within a decentralized protocol which allows for easy borrowing and lending. Borrows can also use tokens as collateral for flash loans.

Maker

Image attribution: Maker

Maker is the governance token used by both MakerDAO and Maker Protocol. The latter is a software platform, and the former is a decentralized organization that uses it. The system as a whole is based on the Ethereum blockchain. The maker tokens act as an entry to the token-based DAO.

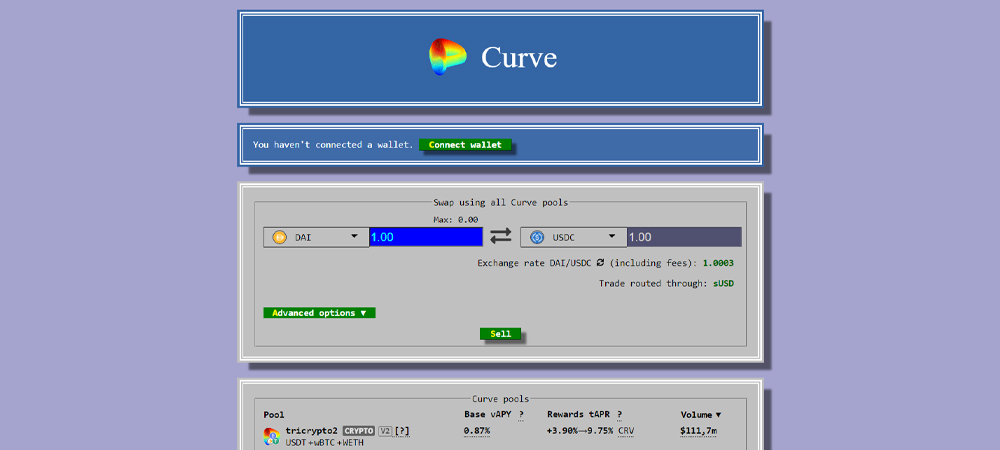

Curve

Image attribution: Curve

Curve is the decentralized exchange associated with stablecoins. It was initially launched in January 2020. And this launch also made it synonymous with decentralized finance in general. By August, Curve became part of a larger DAO system. Like many other DAOs, the system used Curve as a governance token to allow voting.

Dash

Image attribution: Dash

Dash was created in January 2014. The token originated as a form of Litecoin. But since then, it’s taken up a number of new features. This includes a two-tier network, incentives notes with master nodes, and decentralized project governance. This dramatically increases payment settlements. Additionally, a PrivateSend feature added privacy options.

Decred

Image attribution: Decred

Decred was launched in February 2016 to facilitate community interaction, governance, and sustained funding practices. All of this is under the banner of fully transparent and open operation. The community around it maintains the practices of a DAO in order to assure that no central figure can ever take control.

What Do the Critics of DAO Have to Say?

Of course, DAO isn’t perfect, and there are dissenting voices pointing out some of the system’s flaws. One of the biggest problems is highlighted by the initial DAO project. This early project highlighted that DAOs are ultimately held up or let down by the underlying codebase. A flawed codebase is a huge disadvantage for any DAO using it.

Critics within the Massachusetts Institute of Technology also point out that issues might spring up when large amounts of investors collect within a singular whole. The potential risk essentially boils down to the question of whether or not large numbers can properly control something as complex as a DAO. MIT concludes that the world may very well not be ready for such a large-scale collaborative system.

In the end, most of the criticism can be summarized with a single point. DAOs, and even the blockchain, are relatively new technologies. Most scientific studies extrapolate from a large amount of data collected over an extensive period. That’s simply not possible with the newest technologies. What’s more, fast-paced development doesn’t match very well with this methodology. Technology often grows before a proper study has had a chance to conclude properly.

What Does the Future Hold for DAO?

Nobody can be sure what the future holds. At the moment, DAOs are a new technology with many unanswered questions. Different forms of DAOs raise security, structural methodology, and even legality issues. What is clear is that interest in DAOs is continually rising.

Many analysts and investors believe that implementations of DAO are the future of structured businesses. This may come in the form of replacing standard business models as a whole. Or a DAO-based model might find prominence in particular niches. These questions will remain for some time, but DAOs are here to stay.

The Metaverse as a Whole

The influence of DAOs can be felt in almost anything related to the Internet. But it’s especially apparent within discussions of the metaverse. The metaverse offers a whole new way to interact with people, spend money, and operate within a business environment.

The metaverse is essentially a digital world that borders on the offline one. Models like DAO, which present new digital solutions to existing offline problems in the standard world, are a perfect fit for the metaverse. You can learn more about the metaverse in the article “Metaverse Guide; Understanding The Basics Will Open Up a New World”.

Finally, it’s essential to remember that all of these features work within a larger whole. Different tokens and governances offer different takes on DAO. But all of the approaches build within a singular large-scale model for the future.

Leave A Comment